Have any questions?

+62-202-555-0133

+62-202-555-0133

QNUPS (Qualifying Non-UK Pension Scheme) offers British expats a tax-efficient way to protect their assets for future generations

Fill out our quick online questionnaire to see if you qualify for QNUPS.

Speak with our expert to explore how QNUPS fits your financial goals.

Start your QNUPS and enjoy the benefits of wealth growth and protection.

A Qualifying Non-UK Pension Scheme (QNUPS) is an internationally recognised pension structure that allows British expats to transfer and grow their wealth in a tax-efficient way. One of its key advantages is that assets held within a QNUPS are not subject to UK inheritance tax (IHT).

Unlike other pension schemes, QNUPS offers flexibility in investment choices, allowing individuals to diversify their portfolios according to their financial goals.

Additionally, there are no mandatory withdrawal requirements, giving investors full control over how and when they access their funds. This combination of tax efficiency, investment flexibility, and long-term financial security makes QNUPS an attractive option for expatriates looking to protect and grow their wealth.

QNUPS is designed for individuals seeking a tax-efficient way to grow and protect their wealth while ensuring financial security for the future. Whether you are living abroad, planning for retirement, or looking for a long-term investment solution, QNUPS offers significant benefits.

QNUPS provides a way to manage wealth outside the UK while benefiting from exemptions such as no UK inheritance tax (IHT) on assets within the scheme.

With no mandatory withdrawals, QNUPS allows expats to structure their retirement income according to their needs, offering flexibility and security.

QNUPS enables British expats to pass on their wealth efficiently, without the burden of UK inheritance tax, making it a valuable tool for long-term estate planning.

Please answer the following questions to determine your UK tax residency and domicile status. Your responses will help assess whether QNUPS is a suitable solution for you.

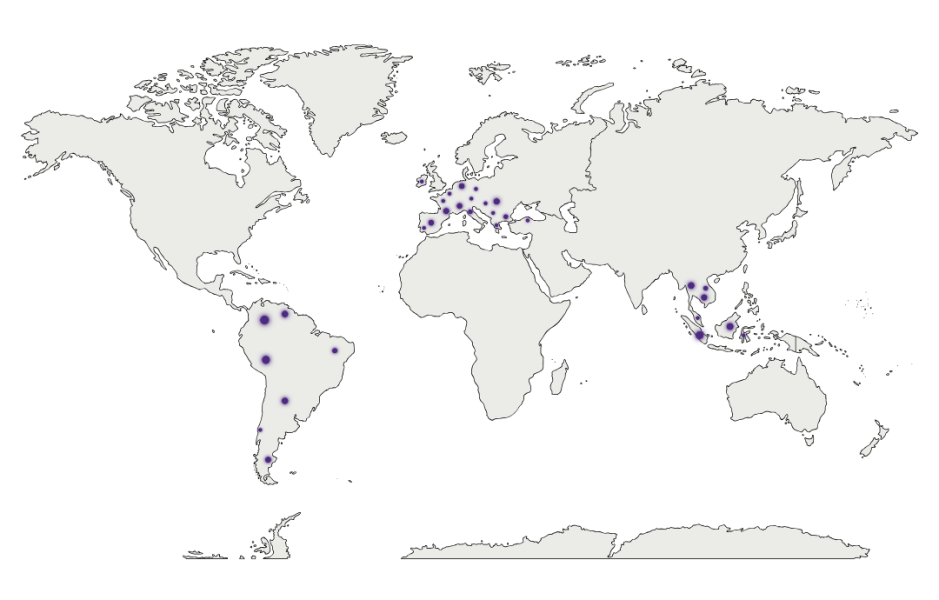

We provide QNUPS solutions across a wide range of jurisdictions, ensuring British expats have access to tax-efficient pension planning no matter where they reside.

With expert guidance and flexible structuring, we help you secure your wealth in internationally recognised financial hubs. Whether you are in Europe, Asia, or beyond, our network ensures seamless cross-border pension solutions tailored to your needs.

GPI Group is a trusted financial planning firm specialising in wealth management and pension solutions for British expatriates.

With deep expertise in cross-border inheritance tax and retirement planning, we help clients navigate complex financial landscapes while ensuring their wealth is preserved and optimised for future generations.

Our tailored solutions provide flexibility, security, and tax efficiency, allowing expats to manage their finances with confidence and build a long-lasting legacy.

Understanding how QNUPS works can help British expats make informed financial decisions. Below are answers to some of the most common questions about QNUPS.

QNUPS offers a broad range of investment options, including cash, equities, bonds, real estate, private equity, and other alternative assets. This flexibility allows British expats to build a diversified portfolio that aligns with their financial goals.

Unlike traditional UK pension schemes, QNUPS has no fixed contribution limits. This means British expats can invest as much as they wish, provided the contributions are made for genuine retirement planning purposes and not solely for tax benefits.

QNUPS is designed primarily for retirement savings, but it offers more flexibility than traditional UK pensions. While early withdrawals are possible, they should align with genuine retirement needs and financial planning objectives.

QNUPS is an internationally recognised pension structure, meaning it remains valid even if you relocate to another country. Its flexibility allows you to manage your wealth efficiently across different jurisdictions while still benefiting from tax advantages.

QNUPS offers several advantages over UK pension schemes, including greater investment flexibility, no lifetime allowance (LTA), no UK inheritance tax (IHT) on assets within the scheme, and no mandatory withdrawals. This makes it a valuable option for British expats looking for long-term wealth preservation and financial security.

Managing your wealth as a British expat comes with unique challenges, from tax implications and pension transfer flexibility to the right inheritance arrangements.

At GPI Group, we provide personalised financial strategies to navigate you through all the pitfalls.

Our team is here to guide you every step of the way. Whether you need assistance with QNUPS eligibility, pension structuring, or cross-border financial planning, we provide expert support to ensure a smooth and informed process, giving you peace of mind and confidence for the future.

office@gpi-qnups.com

+62-864-349-1

Need A Consultation ? Call us today +62-202-555-0133 or email us : office@gpi-qnups.com

Secure your wealth with a tax-efficient pension for British expats!

Copyright © 2025 GPI Group. All rights reserved.